At the beginning of 2023, Amazon updated their policy for calculating VAT in Europe. They are now applying specific VAT calculations for certain types of listings in their European stores if you deal with business-to-business (B2B) orders. B2B merchants can also take advantage of reverse charge VAT with the new update in place.

This article provides information about the Amazon reverse charge for B2B merchants. We’ll explain how it works and discuss the implications of the recent VAT changes on your business.

What is Amazon reverse charge?

This method is used in business-to-business orders to manage VAT. It aims to prevent fraud and streamline the VAT payment process.

Rather than paying the VAT upfront and seeking an Amazon VAT refund later, the reverse charge method eliminates the initial VAT payment altogether. Basically, if you’re selling your products to another legitimate business, Amazon VAT won’t be charged or reclaimed.

How does Amazon reverse charge work?

When a reverse charge applies, you need to submit an invoice without adding VAT. Instead, the buyer will calculate and pay the VAT themselves. In a reverse charge transaction, there are specific things the supplier and the customer need to do.

Supplier. The supplier issues an invoice without VAT. This invoice requires specific information like the buyer’s VAT number and a note stating that a reverse charge applies.

Customer. The customer receives an invoice without VAT. However, when preparing their VAT return, the customer manually calculates the VAT amount and reports it as both due and deductible. For instance, if Business A issues a reverse charge invoice to Business B for €200, Business B will pay only €200 to Business A.

When Business B prepares its VAT return, it calculates the VAT on the €200 (with a 10% VAT rate), which amounts to €20. Business B reports these €20 under the sales section (output VAT) and the purchases section (input VAT) of its VAT return. By offsetting the amounts, no VAT payment for this invoice is made to the tax authorities.

Essentially, the process is as follows:

- The buyer gives their valid VAT number to the merchant during the transaction. Amazon will keep this number on record for business purchases.

- If everything checks out, the transaction proceeds without any VAT being added or paid.

- In the buyer’s VAT return, they report their purchase (input VAT) and the merchant’s sale (output VAT). This effectively cancels out the VAT payments in terms of cash flow.

When Amazon don’t charge VAT on B2B transactions?

A 0% VAT rate, which is also known as the product-related domestic reverse charge, will be applicable to sales that meet the following criteria:

- The sale involves electronic items, such as cell phones, computer chips, e-readers, laptops, tablets, or video game consoles. The specific items subject to the reverse charge may vary by country.

- The sale is made between businesses within the same country.

- The total value of the shipment exceeds the relevant threshold, which is typically around EUR 5,000.

These changes will be applicable in the following countries: the United Kingdom, Germany, Romania, the Czech Republic, Austria, Denmark, and Latvia.

More details and more specific guidelines can be found on the Amazon page on changing the European VAT calculation.

How does Amazon reverse charge affect your business?

If you’re on special VAT schemes or trade below the VAT registration threshold, the reverse charge changes will affect you the most. The price paid by the buyer will be exclusive of VAT, regardless of whether VAT is included in the pricing or not.

Summary

Amazon European VAT calculation procedures keep changing. Staying informed about these regulatory changes will help you maintain compliance and navigate the evolving landscape of European VAT calculations on the Amazon platform.

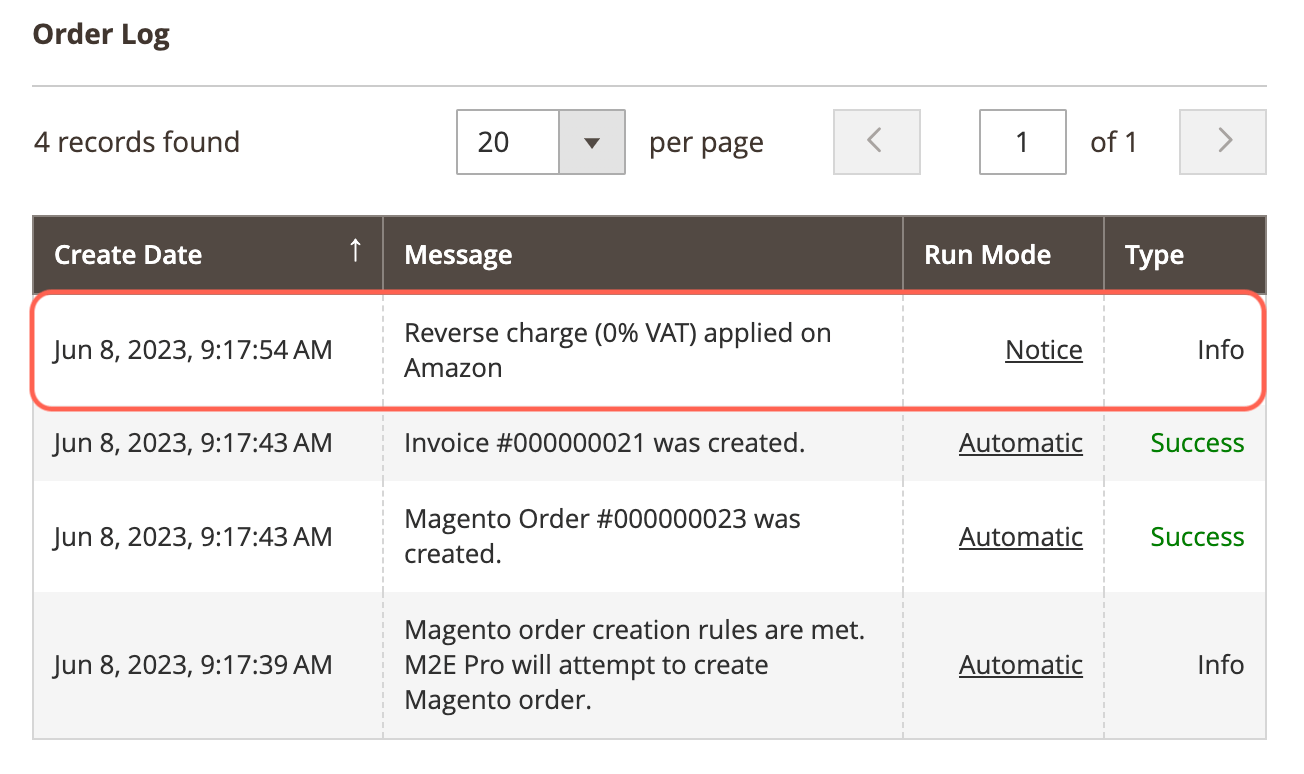

M2E Pro is always up-to-date with the latest VAT-related changes on all supported marketplaces. If Amazon reverse charge is applied to the purchase, you’ll see a VAT 0% value in your Amazon and Magento orders, as well as a relevant message in your order logs.